The Relevance of Currency Exchange in Global Trade and Commerce

Currency exchange functions as the foundation of international profession and commerce, enabling smooth purchases in between diverse economic climates. Its influence prolongs past mere conversions, influencing rates techniques and revenue margins that are vital for organizations running worldwide. As variations in currency exchange rate can posture substantial risks, reliable money risk monitoring ends up being paramount for keeping a competitive side. Recognizing these dynamics is important, particularly in an increasingly interconnected marketplace where geopolitical unpredictabilities can additionally complicate the landscape. What are the implications of these variables on market accessibility and long-lasting organization techniques?

Role of Money Exchange

Currency exchange plays an essential duty in assisting in international trade by making it possible for deals between events operating in various money. As organizations progressively engage in global markets, the requirement for effective currency exchange systems comes to be critical. Exchange rates, which change based on different economic indications, determine the worth of one money about an additional, influencing trade dynamics considerably.

Furthermore, currency exchange minimizes dangers related to foreign deals by providing hedging options that protect versus unfavorable money motions. This economic device enables organizations to stabilize their costs and incomes, better promoting worldwide profession. In recap, the function of money exchange is central to the functioning of international business, providing the important framework for cross-border deals and sustaining financial growth worldwide.

Influence on Rates Approaches

The mechanisms of money exchange considerably influence pricing strategies for companies engaged in global trade. When a domestic money reinforces versus international money, imported products may become less expensive, enabling businesses to lower prices or increase market competitiveness.

Furthermore, companies should think about the economic conditions of their target markets. Neighborhood buying power, inflation rates, and money security can determine exactly how products are priced abroad. Firms frequently embrace pricing approaches such as localization, where rates are customized per market based upon money changes and neighborhood financial aspects. Additionally, vibrant pricing versions might be used to respond to real-time currency activities, making certain that organizations stay nimble and competitive.

Impact on Earnings Margins

Varying exchange prices can greatly impact revenue margins for organizations participated in worldwide trade. When a firm exports products, the earnings created is typically in an international money. If the worth of that money decreases relative to the business's home currency, the revenues understood from sales can lessen significantly. On the other hand, if the foreign currency values, revenue margins can boost, boosting the total economic efficiency of the service.

Furthermore, companies importing goods face comparable threats. A decrease in the value of their home currency can lead to greater prices for international products, subsequently squeezing earnings margins. This scenario requires effective currency threat administration techniques, such as hedging, to reduce potential losses.

In addition, the influence of currency exchange rate fluctuations is not restricted to route deals. It can also influence prices techniques, affordable placing, and overall market characteristics. Business should continue to be cautious in keeping an eye on currency trends and changing their economic strategies as necessary to shield their profits. In summary, understanding and taking care of the influence of money exchange on revenue margins is vital for businesses making every effort to preserve profitability in the complicated landscape of global profession.

Market Gain Access To and Competition

Navigating the complexities of international profession requires services not just to manage revenue margins however additionally to ensure efficient market accessibility and boost competitiveness. Currency exchange plays an essential duty in this context, as it directly influences a business's capability to get in brand-new markets and compete on an international scale.

A positive currency exchange rate can lower the cost of exporting goods, making products much more appealing to international customers. Alternatively, an unfavorable rate can inflate prices, hindering market his response penetration. Business should tactically handle money changes to maximize rates approaches and continue to be affordable versus local and global players.

Furthermore, organizations that effectively utilize money exchange can develop possibilities for diversity in markets with desirable problems. By developing a strong presence in multiple money, organizations can minimize threats related to reliance on a single market. forex trading forum. This multi-currency strategy not just improves competitiveness but also cultivates durability when faced with economic changes

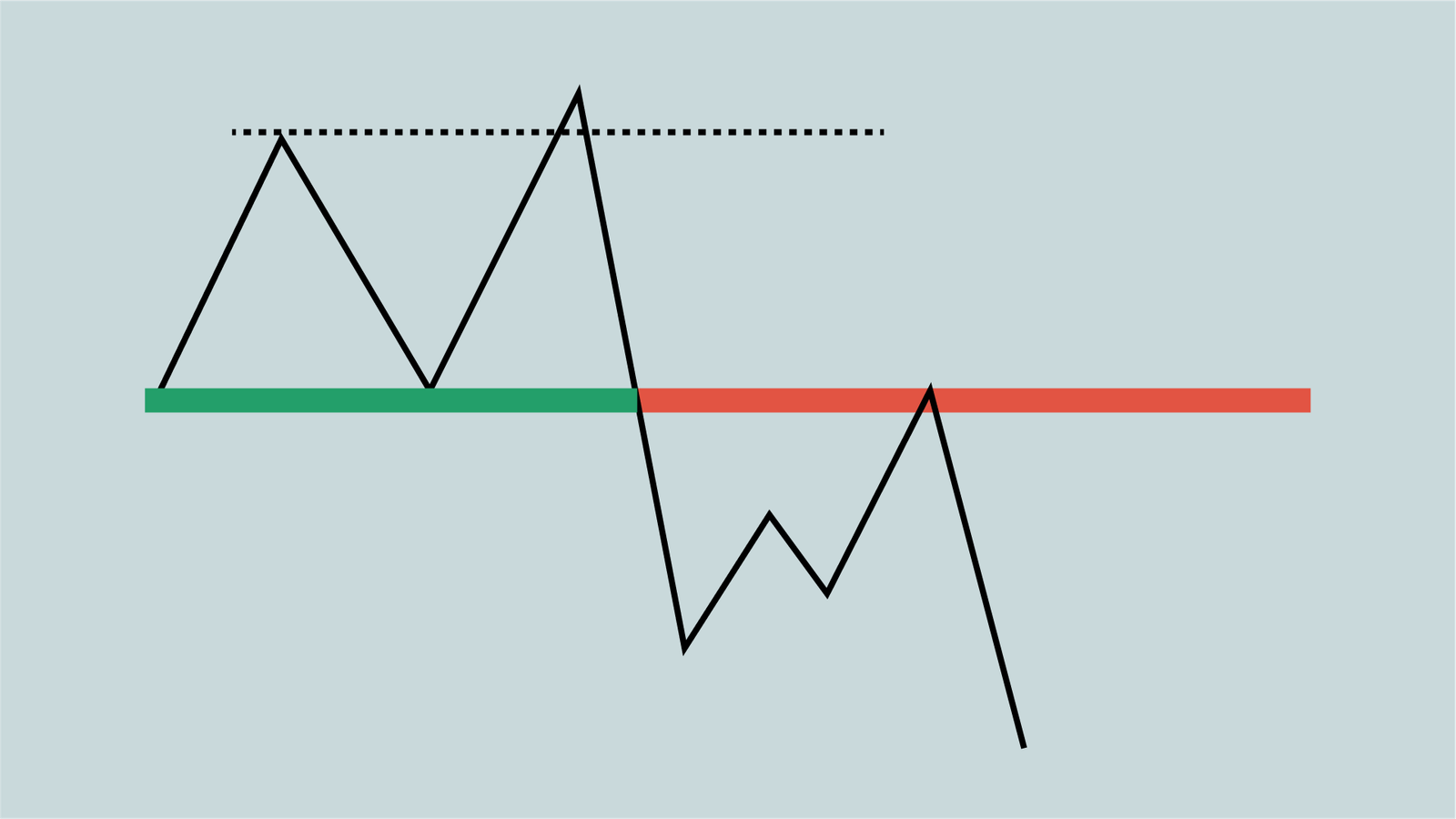

Dangers and Difficulties in Exchange

In the realm of global profession, services face significant threats and difficulties related to money exchange that can affect their financial security and functional techniques. Among the main risks is currency exchange rate volatility, which can lead to unexpected losses when transforming money. Fluctuations in exchange prices can impact profit margins, specifically recommended you read for companies involved in import and export activities.

Additionally, geopolitical aspects, such as political instability and regulatory adjustments, can intensify money threats. These elements might result in sudden shifts in money values, making complex monetary projecting and planning. Furthermore, services must browse the complexities of international exchange markets, which can be affected by macroeconomic signs and market view.

Verdict

In click for info conclusion, money exchange serves as a foundation of global profession and business, helping with purchases and improving market liquidity. Regardless of fundamental threats and challenges linked with fluctuating exchange prices, the significance of currency exchange in cultivating economic growth and strength remains indisputable.